Market Mechanics in Dentistry

I started with, "Why is dentistry so expensive?"

Preface: how things are today is continuous with events in the past, and sets the stage for what is to come

Dentistry in Canada wasn't always unaffordable. I've had dental instructors at the University of Toronto show off pictures of their invoices for services rendered in the 1970's. $8 for a filling, $10 for an extraction ($32.xx, and $40.xx respectively, adjusted for inflation). Please send me vintage receipts for dental services, I'd really appreciate it. Adjusted for inflation, the average hourly wage in 1977 was $24, whereas the average hourly wage in 2016 was $27.70. A filling today may cost $161 - $330+ in Ontario, and an extraction $145 - $227+.

On average, 2 hours of wage can pay off a filling/extraction in 1977, but in 2016, you'll need 5-8 hours to do the same.

Our provincial fee guides for dental services also increases yearly to adjust for inflation:

So, wages are stagnant, and inflation happens - that's nothing new. There's a bigger picture that I'm drawing.

Canadians: Record levels of Debt

At the end of 2017, Canadian households owed just over $2 trillion. Household debt is around 170 per cent of disposable income. In other words, the average Canadian owes about $1.70 for every dollar of income he or she earns per year, after taxes. On top of that, half of Canadians homeowners lack a proper emergency fund. I find it unsettling that the root canal treatment and crown ($2000+) which is necessary to save a tooth will put half my patients at financial duress. So I often find myself negotiating compromised treatments to address an issue for the short-term, fully knowing that the long-term consequences of such decisions become more difficult and more costly to fix. What's more, I find that a lot of patients are embarrassed that they can't afford standard-of-care treatment, unknowing that they are the norm rather than the exception.

Tuition for dentistry has risen significantly over the years: $39,240 for tuition alone in 2017-2018. Please send me figures for earlier years. For the academic year 2003–2004, total expenses for housing, tuition, food, clothing, debt-serving, entertainment, was $37,500. I tried to go through the process of opening up a dental office in a 1750 sq ft. retail space in the north end of GTA. I'd be paying approx $115,000 rent/year, $220,000 in leasehold improvements, $375,000 in equipment and supplies for a 3-chair starter practice. Acquiring new patients is very difficult in today's dental industry. The high level of debt is bound to influence business decisions at the expense of my Patients' experience.

Dental Economics

When a dental clinic is sold, the most valuable asset is the goodwill of its existing patient base. Each patient, depending on the frequency of visits will be valued at a price of $2000-$2500+ during the sale of a clinic. Patients are a scarce commodity in today's dentistry, and practitioners are abundant. You'd think that with fierce competition for patients, dental services would be better and prices would be lower, but that's not the case.

As we'll examine later, the overhead costs of running a dental office have become dauntingly high. I will make the case that as debt burdens increase, the greater the effect on the behaviour of a dental office, which ultimately leads to the detriment of the Patient's care.

Pricing of North American dental clinics are heavily influenced by external sources of equity. When a clinic is sold, a good metric for price evaluation is EBIDTA (Earnings Before Interests, Depreciation, Taxes, Amortisation). A clinic selling in 2008-2009 will typically go for 4-6x EBIDTA, but as of 2018, it's not uncommon to see 11.5-14x EBIDTA. Ontario Teacher's Pension Plan (OTPP) is amongst one of many organisations who have acquired significant shares in US dental corporations. The OTPP fund was worth $117.1 billion in assets at December 31, 2011; it was worth $180.5 billion in net assets at June 30, 2017 (dentistry assets make up 1-2% of net assets). The dental industry has exceeded healthy levels of sustainability, but yet clinic prices are still pumping and following the money trail leads to big players handling publicly-accountable equity. Something is off.

Government and Regulation will save us

No it won't. I wish they could, but they can't. There are plenty of reasons not to expect greater powers to save us.

Politics: Muddy Waters. Our government may not act on behalf of the best interests of its constituents - examine some government programs and see if you agree. We have a program called the Interim Federal Health Program (IFHP), which pays out about 70-80% of the standard fee guide for refugees. I understand that we need a safety net for individuals seeking to escape tyranny, but I don't understand the ethics of prioritising dental care of non-citizens over existing citizens. There are also generous dental benefits provided by our government for interns/students visiting from certain countries. Why were certain subgroups given dental care at the expense of existing citizens, despite knowing that a large chunk of our citizens desperately need dental care and can't afford it?

Government Programs: Poorly conceived. Healthy Smiles Ontario (HSO), Ontario Disability Support Program (ODSP), Ontario Works (OW), pays 20-40% of the standard fee guide costs. Many of you have experienced rejection from dental clinics who refuse to accept these plans - that's because dental clinics don't make money from these programs. A tooth extraction pays $19.00 on OW, $38.01 on HSO/ODSP. The overhead costs of running a dental clinic exceeds the payout, so it's a rational business decision to not accept these benefits. If a clinic does, consider it charity. No sound business operates to lose money.

Regulatory Bodies. Dentistry is a self-governing profession, with the Royal College of Dental Surgeons of Ontario (RCDSO) acting as central governing body. They have a tough job to do. They regulate professional standards and ensure public protection and safety. You may ask, if 50% of Ontarians can't afford standard-of-care treatment, are they doing a good job? There are some regulations which the RCDSO can loosen (e.g. permitting access to international markets for supplies/equipment, allowing the sale of second-hand CT machines), to reduce overhead costs which are passed onto the Patients. However, as you'll see, regulatory responses within the dental profession don't make enough of an impact to really affect the cost of dentistry.

Imported heath/dental. Trade wars are all the hype on the news nowadays. We import 80% of medical devices in Canada, with imports growing at a faster rate. In dentistry, equipment/supplies imports are monopolised by a few US-based distributors (Henry-Schein, Patterson, Benco). There is an ongoing FTC lawsuit on price collusion amongst these distributors. Watching the case unfold is kind of funny:

If central authority is willing to help, but unable, then they are incompetent. If central authority is able to help, but unwilling, then they are malicious. It appears as though appealing to authority does not yield acceptable solutions.

Following the Money Trail

Here is an example of money flowing from government into corporate dentistry: Government deficit spends (creates money to pay teachers) -> Mandatory chunk goes into Pension Plan -> Private equity investors allocate funds -> Big dental corporations get bigger. Ever wondered why teacher's benefits are amongst the best in the dental industry?

It appears that the pensioners win, hedge-funds wins, values of existing practices skyrockets, and all is good. Well no, this is a dangerous and unsustainable practice that destabilises the dental industry at the expense of the Patients' well-being, as explained below:

The price of a dental clinic is increasing because the market is assigning a higher and higher value for the goodwill of dental patients. On the balance sheet, increased goodwill looks great for the value of a clinic, but realistically, we're overestimating the amount of dental work that a patient requires. The amount of dental work needed provides a real level of grounding. In 2014, the market calculates that each patient was worth on average $660CAD/year in revenue. For the goodwill to increase, either more dental work was being done per patient, or patients are becoming scarcer and more valuable. Both may be true.

Big corporations can buy out smaller clinics because they are backed by enormous equity. This is the main factor for driving up the goodwill price. Take note from Timothy Brown, president and CEO of ROI Corp., a Mississauga, Ontario-based brokerage that sells dental, optometry and veterinary practices. "These are profitable business systems, so that’s why they’re buying them. Corporatization or accumulation of multiple locations leads to tremendous economies of scale.” As evidenced by the actions of OTPP, publicly-accountable organisations want in on the action as well.

Corporate dental practices answer only to their investors. Large hedge funds look to squeeze as much profit out as possible before flipping their practices. In the process, you, the Patient, will experience increased sales tactics in an environment where the emphasis should first and foremost be about your oral health. Make no mistake, the dental industry is in the mid-late stages of pumping, and amongst older practitioners, the conversation-du-jour is about when exactly to dump.

Healthcare: show me the money

Dentistry isn't covered by Medicare in Canada - the system is stretched so thin already. Healthcare is the single largest budget item for every province in Canada, ranging from 34.3 percent of total program spending in Quebec to 43.2 percent in Ontario in 2016.

In 2001, provincial governments spent a combined $68.5 billion (about $2,209 per person) on healthcare.

In 2016, provincial governments spent a combined $228.1 billion (about $6,299 per person) on healthcare.

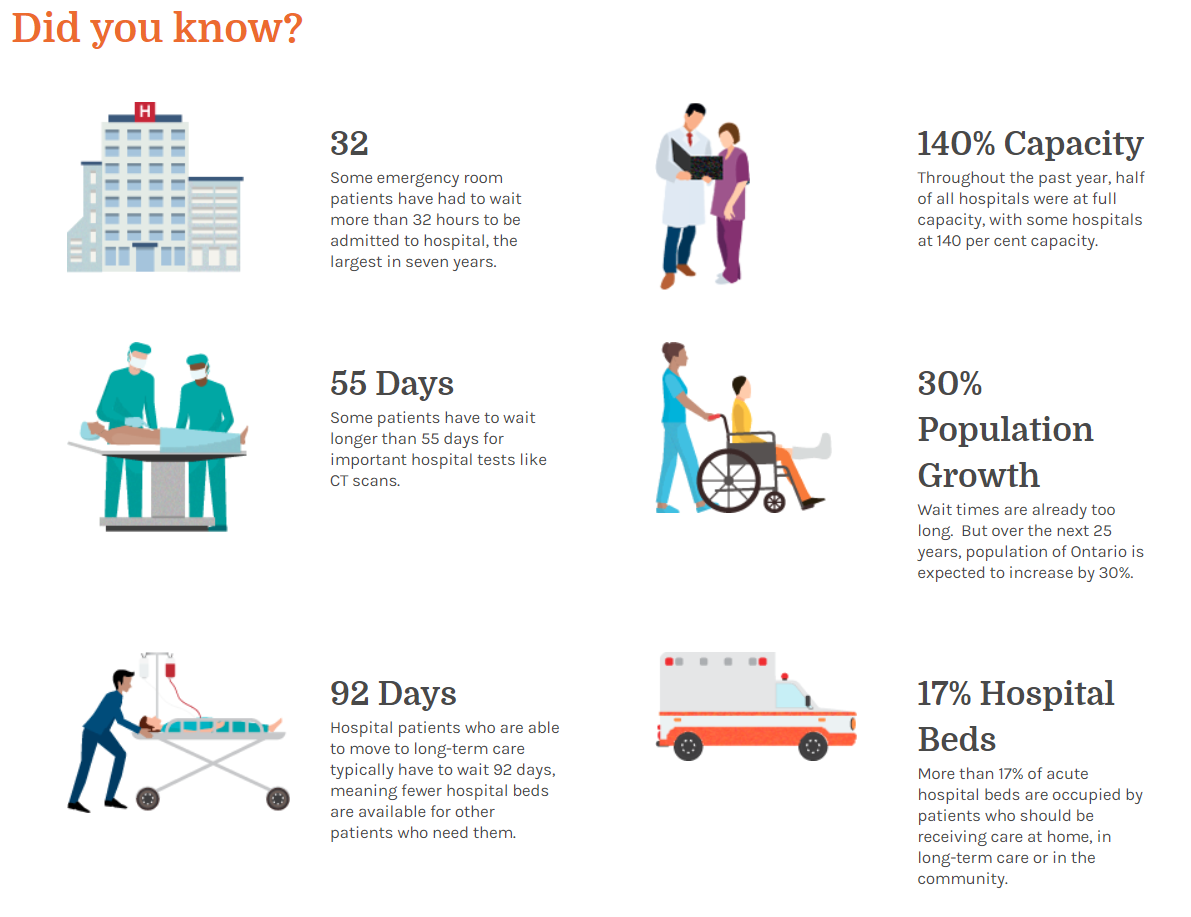

You'd think that with increased funding, we'd have better healthcare. Well, no. In fact, the Ontario Health Association is sounding the alarm for being on the brink of collapse. This is not new either, the public healthcare sector has consistently been short on resources.

But there's more doom and gloom. Health care spending by provincial governments will increase by approximately 5.3 percent per annum over the next 15 years - increasing 118.5 percent from $148.3 billion in 2016 to $324.0 billion by 2031.

at 60+, they utilise more resources

A significant portion of our population is going to be 65+

That's an issue. Where does the money come from?

Flawed foundations - systemic issues

We'll print more money. That's right. We'll create money that we don't have to keep everything afloat. This is what all countries do, and that's fine, right? Canada has 0% fractional reserve requirement, which means that banks can lend out an infinite amount of money. Canada began phasing out cash reserve requirement in 1992 and removed it in 1994. If you are interested, see BOC Working Paper 97-8 (April 1997) "Implementation of Monetary Policy in a Regime with Zero Reserve Requirements" by Kevin Clinton. When you and I write a cheque, an amount is deducted from our balance and added to the payee's account. When the bank writes a cheque, money is created and dilutes the value of all existing money.

The aforementioned has disastrous implications for the future of publicly funded healthcare, private dentistry, as well as every other industry taking on sizeable loans.

We've observed that:

Elastic money supply in the hands of a few reverses the trend of private capital formation, and allows large players to capture entire industries

Banks are more than happy to make over-leveraged loans, despite unfavourable market trends

The costs to recover such over-leveraged loans are passed on to the consumer. This amplifies the profit-incentive at the expense of the consumer.

How it usually plays out:

Should over-borrowing eventually lead to the collapse of the banking system, the losses are shifted from banks to taxpayers

in dentistry, shareholders will be holding empty bags

Government is convinced that the measure was to protect the public's best interests

In summary:

Dentistry is expensive for you, because it is expensive for the dentist. There are large entities leading all the way to the central banks and government which stand to gain from keeping dentistry expensive. This is cartel-like behaviour operating against the public's best interests.

The take home message for canadians

I omitted the following, but I saved the best for last. This is the only message that I think you'll remember in this piece.

I see around 15 patients a day. I've worked 4 years in private practice. I know that about 50 percent of you can even afford/have insurance to see a dentist regularly. I see around 3 a week who experiences this situation: Patient presents to clinic with agonising pain. The tooth is very much salvageable, and an important one to keep in the mouth. The ideal solution is to save the tooth via root canal treatment.

About half of you couldn't afford $600 - $2000, because it would put you behind on rent/mortgage. Less of you can afford this since the 2017 housing peak.

In other words, half of us would rather rip a tooth out of their skull to relieve short term pain, fully knowing that the consequences are more costly to deal with in the long-term. This is putting money where your mouth is at the most literal level, and is telling of a bleak state of financial duress. It is rational for me to question my country's financial health.

- Dr. C